Project Description

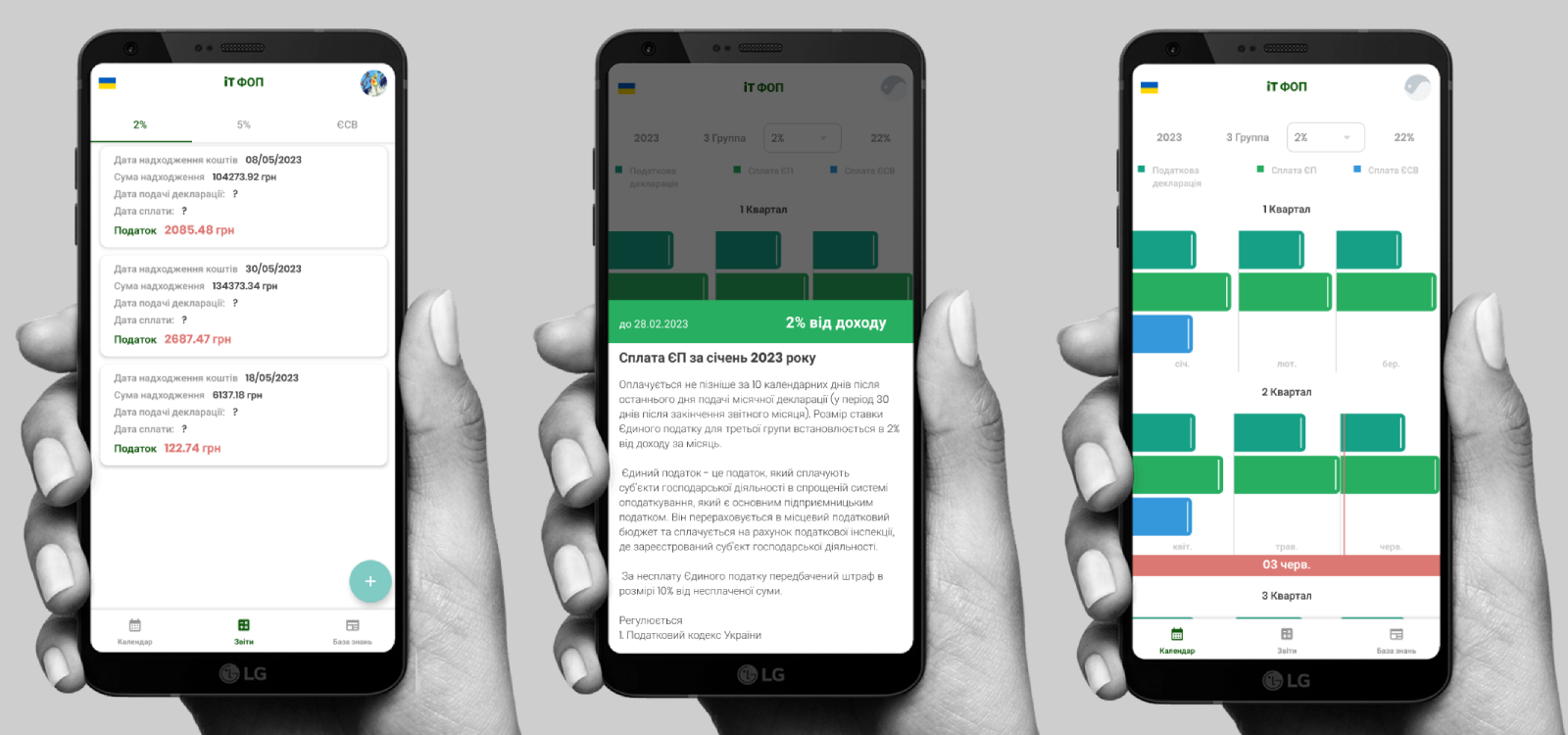

This mobile application was developed with individual entrepreneurs in mind, aimed at providing relevant tax obligation information and ensuring convenient access to essential reporting tools.

Built using Kotlin, the app offers a comprehensive insight into the tax calendar. Users can easily view dates and deadlines for submitting 2% and 5% reports.

The application also features a section dedicated to tax news, where users can keep themselves updated with the latest tax-related updates. Moreover, it provides access to video tutorials that assist users in understanding the reporting process and filling out the necessary forms.

Leveraging Google authorization, the app allows users to quickly and easily sign into their accounts. Additionally, it facilitates managing 2% and 5% reports directly from mobile devices. If a user handles a 5% report, it is grouped quarterly, thereby simplifying the reporting process.

The app also supports Unified Social Tax (UST) reports, giving users the ability to view information about paid amounts and the number of insurance contributions.

The entire application was constructed on a Firestore database, which aids in the secure and efficient handling of user data and reports.

Overall, this mobile application is a beneficial tool for individual entrepreneurs, helping to ensure accuracy and timeliness in report submissions and tax information updates.